Peerless Tips About How To Lower Monthly Payments

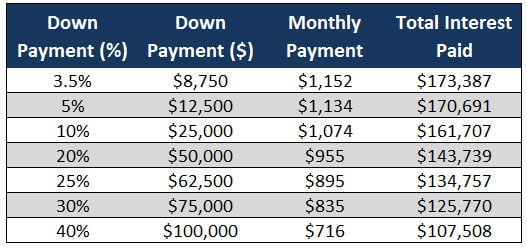

If it is manageable, another way to lower the monthly payment is to add a cash to the down payment.

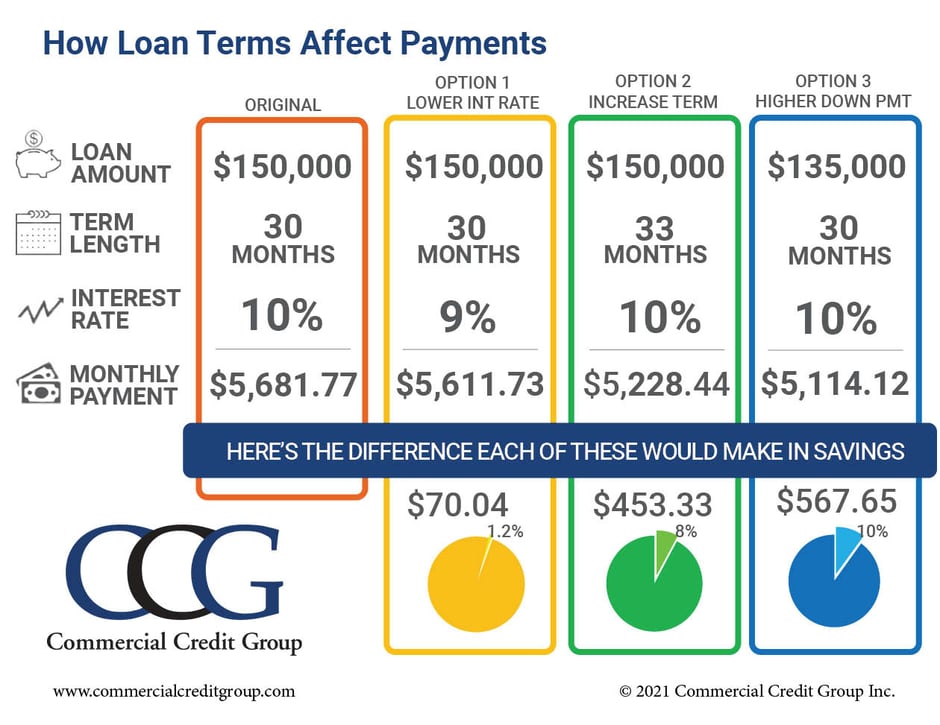

How to lower monthly payments. However, you need to pay $1,500 in closing costs to get a new mortgage with a lower rate. This is the most direct way that someone can lower their monthly mortgage payments. One of the simplest ways to reduce your monthly credit card payment a bit is to lower your interest rate.

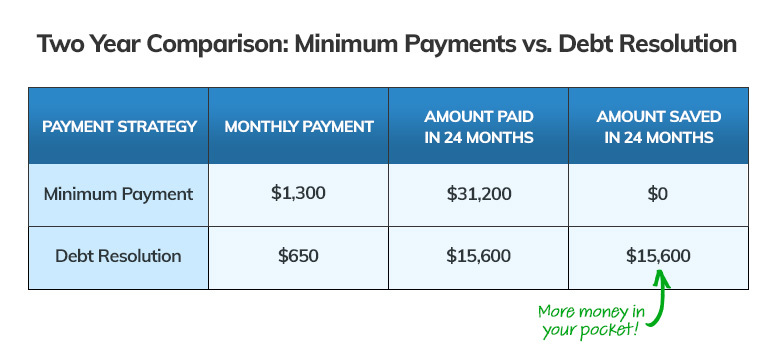

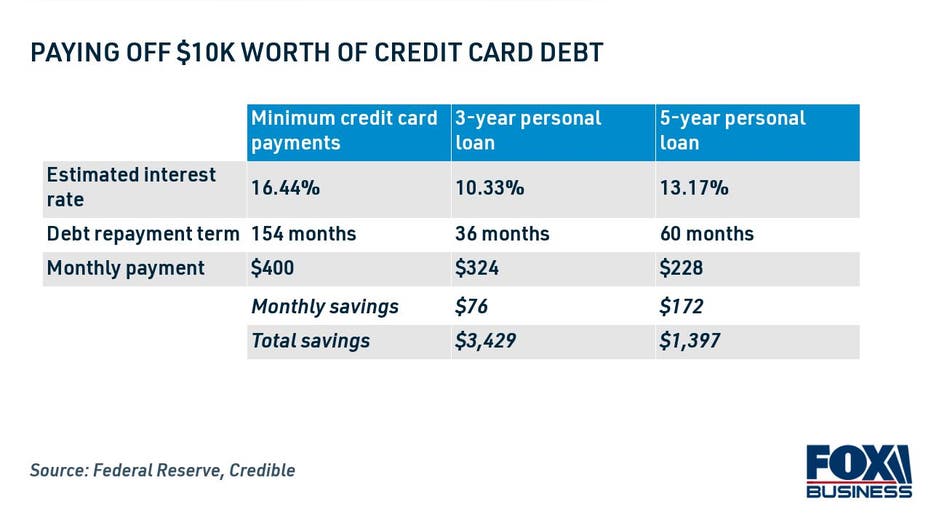

You may be able to lower your monthly payments if you consolidate multiple loans or credit cards into one new loan with a lower rate or longer. You can try to negotiate with your lenders for a lower monthly payment. A vertical stack of three.

Tanya burnett refinanced her student loans to lower her monthly payments. Ad one low monthly payment. For example, say lowering your interest rate lowers your monthly payment by $100.

Contact them and explain your situation. There are two ways to lower your interest rate. Paying on the principal reduces the loan.

Under an idr plan, payments may be as low as $0 per month. Consider refinancing consolidate your debt. By refinancing your mortgage to a longer term, you’re essentially giving yourself a longer period of time to pay off your mortgage.

The average monthly payment on a used car is about $400, while the average monthly payment on a new car is roughly $536. But now, she says it wasn't worth it since she can't get federal relief. Choose from multiple options so you can build the future you want.